Inheritance Timing

Show Table of ContentsIn general, most estates take 6-18 months to finalize, but some can take years.

Automatic Transfers

Assets with named beneficiaries (such as IRAs, 401Ks, and life insurance policies) transfer outside the estate, and generally complete within a few weeks. Generally, you (or the executor of the estate) will need to notify the current asset holder (e.g., Bank of America) that the previous owner passed away, provide proof such as a copy of a death certificate, and fill out any requested paperwork.

Probate

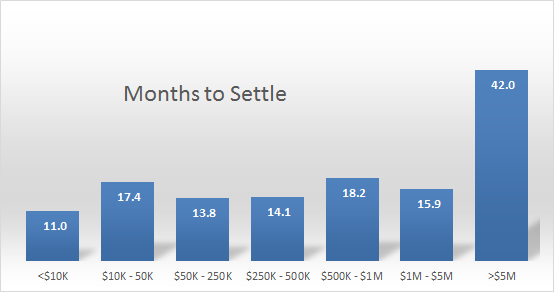

If you are inheriting via will or intestate succession, you can expect to wait much longer. Most such estates undergo probate, which takes 16 months on average. Very small estates (<$10K) have a somewhat shorter settlement duration, and very large estates (>$5M) take almost 3 times as long, but in between those extremes, duration is fairly unrelated to size. Roughly 80% of all estates are settled within 18 months.

Probate generally starts within 3-6 months after the death, although some states mandate certain actions sooner (and some require certain minimum waiting periods). Few states have actual limits on when probate must start, but if nothing happens for too long, you can petition the probate court to get things moving yourself.

Going through probate is a lot of work for the executor, and there are various mandated waiting periods to ensure that creditors, government agencies, and potential heirs have a chance to react to the death, and make any claims or objections. The complexity and particulars of the estate can drastically affect how long it takes to settle, so there's no hard and fast rule about when you should expect your inheritance.

If the estate is undergoing probate, the rough sequence of events will be:

- Receive notification that the probate process has started, or will start soon

- Receive a copy of the estate inventory

- Wait while the executor collects the assets and resolves the debts

- Receive a copy of the Final Accounting, including intended distributions

- The executor will pay any required inheritance taxes out of your share, on your behalf

- Receive your inheritance and sign the receipt

Distributions normally occur at the end of the settlement period, among other reasons to avoid any issues if new debts become known late in the process. Executors can be held personally liable if they distribute funds early, and then don't have enough estate resources to meet other obligations. Consequently, while it may be possible to convince an executor to give you some or all of your inheritance before the settlement completes, best practice for the executor is not to do so.

Because of these dynamics, an industry has developed that commercially provides advances on inheritances, in exchange for a percentage of the inheritance when it finally becomes available. These advances can be a godsend if you need the money right now, but they are expensive in terms of the amount of the inheritance the providers will ultimately keep for themselves, in order to cover their costs and their risks. With those caveats in mind, here are some resources that may be helpful:

- Finder for Better Decisions — Explains inheritance advances and estate loans

- Inheritance Funding — Perhaps the #1 source of inheritance loans while waiting for probate to complete

- Probate Advance — Alternate source of cash advances for an estate or for an heir

Small Estates

If the estate is not going through probate, and you are instead using a small estate process, then things can proceed much more quickly. States usually mandate a several week waiting period after the death, and then you can take action to collect your inheritance as per the specific process defined in the decedent's state of residence (see Small Estates Process for state-specific details).

EstateExec™ Leaves More $ for Heirs!

EstateExec will likely save the estate thousands of dollars (in reduced legal and accounting expenses, plus relevant money-saving coupons), leaving more funds for distributions to heirs.

- Awarded Best Estate Executor Software in North America at the Worldwide Finance Awards

- Named Best Estate Executor Tool – – by Retirement Living

- Web Application of the Year Winner at the Globee Business Excellence Awards 2022

- Winner of Best Executor Software at the Software and Technology Awards

- Rated 4.9 stars – – on TrustPilot reviews